Crypto Exchange Centralization

Recent exchange errors and operational irregularities have reminded participants of an uncomfortable truth: decentralization at the protocol level does not guarantee decentralization at the market level. Trading volume remains concentrated, custody layers remain clustered, and liquidity flows through a narrow set of infrastructure providers.

This concentration exposes a structural weakness. When capital, order routing, and asset storage depend on a handful of venues, stability becomes conditional. Markets may appear resilient during calm periods, yet fragility increases beneath the surface.

At the center of this issue lies crypto exchange centralization. Despite narratives celebrating distributed networks, price discovery and liquidity formation rely heavily on centralized platforms. That dependency shapes risk more than short-term volatility.

Understanding this structural imbalance matters for traders, long-term holders, and miners alike. Infrastructure concentration influences liquidity depth, execution quality, and systemic resilience. When one layer falters, ripple effects extend beyond a single platform.

This analysis moves beyond headlines to examine how exchange dependence quietly shapes modern crypto markets—and why that risk deserves closer attention.

The Illusion of Decentralized Liquidity

Crypto is often described as decentralized because its underlying networks operate through distributed consensus. However, market activity tells a different story. A large share of global trading volume flows through a small number of exchanges.

Liquidity concentration distorts perception. Deep order books on major venues create the impression of robust markets, yet much of that depth is venue-specific. Remove one large exchange from the equation, and available liquidity contracts rapidly.

Moreover, cross-exchange arbitrage depends on stable connectivity between these centralized hubs. If routing slows or withdrawals freeze, fragmentation increases and spreads widen. What appeared unified becomes segmented.

Although protocols remain decentralized, trading infrastructure does not. Crypto exchange centralization therefore creates a structural gap between technological ideals and market reality.

Infrastructure Layers Few Participants See

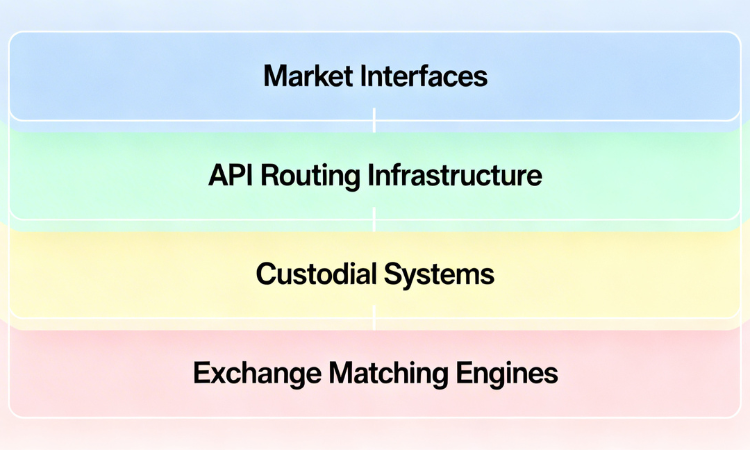

Beyond visible order books lies a complex web of backend systems. Matching engines, custodial aggregation layers, and liquidity providers form the operational core of exchanges. These systems are rarely transparent, yet they control execution reliability.

Custody concentration intensifies this risk. Many exchanges rely on shared service providers or overlapping liquidity sources. When dependencies overlap, systemic exposure increases. A disruption in one service layer can cascade through multiple platforms.

API routing also amplifies concentration. Algorithmic traders often depend on stable exchange connectivity. If latency spikes or access restricts suddenly, execution quality deteriorates quickly.

In this context, crypto exchange centralization is not merely about ownership structures. It reflects interconnected infrastructure dependencies that few retail participants examine.

Why Recent Exchange Errors Matter

Operational misallocations or accounting discrepancies may appear isolated at first. However, they reveal deeper issues related to transparency and internal controls. Markets price risk based on trust in infrastructure. Increasing regulatory oversight, as discussed in our crypto legislation analysis, reflects growing concern over infrastructure concentration and systemic exposure.

When exchange integrity is questioned, liquidity thins. Participants reduce exposure, withdraw assets, or pause activity. Even temporary uncertainty can widen spreads and increase slippage.

These events highlight a structural reality. Centralized venues aggregate enormous responsibility: custody, clearing, settlement, and price discovery. If safeguards fail, market stability depends on rapid containment.

Through this lens, crypto exchange centralization magnifies the consequences of operational mistakes. Concentration turns localized errors into system-wide concerns.

Liquidity Stability vs Structural Fragility

During normal conditions, centralized exchanges provide efficiency. High throughput, low latency, and deep books attract capital. Stability appears natural.

However, resilience is tested during stress. As explored in our analysis of crypto market liquidity, depth only reveals its true strength when markets face structural pressure. If withdrawals spike or leveraged positions unwind simultaneously, order book depth can evaporate. Liquidity that seemed permanent reveals its conditional nature.

Dependence on a limited number of hubs means fragility scales with size. Larger exchanges do not eliminate risk; they concentrate it. When volume clusters, exposure clusters as well.

As a result, crypto exchange centralization creates asymmetry. Growth increases efficiency but also increases systemic sensitivity.

Mining and Exchange Interdependence

Mining economics intersect directly with exchange infrastructure. Miners rely on centralized venues to convert block rewards into operational capital. Energy costs, equipment financing, and liquidity cycles all pass through these gateways.

If exchange stability weakens, miners face additional uncertainty. For long-term holders, this reinforces the importance of understanding crypto ownership responsibilities beyond simple price exposure. Delayed withdrawals, reduced liquidity, or spread widening can affect selling strategies. This linkage reinforces structural dependence.

Although mining secures decentralized networks, its economic viability remains tied to centralized trading layers. Crypto exchange centralization therefore influences not only traders but also the security backbone of the ecosystem.

ETF Flows and Custodial Bottlenecks

Institutional participation often enters through structured products. ETFs and custodial services aggregate assets under regulated frameworks, adding another layer of concentration.

While these vehicles increase legitimacy, they also cluster custody and settlement processes. Capital may appear diversified, yet operational control remains narrow.

If large custodians experience stress or regulatory friction, market liquidity can shift abruptly. Institutional flow, therefore, does not automatically decentralize infrastructure.

In this environment, crypto exchange centralization extends beyond retail platforms into institutional custody layers.

What Real Market Decentralization Would Require

True decentralization at the market level would demand distributed liquidity, transparent reserves, interoperable settlement systems, and reduced reliance on single custodial points.

Such transformation requires structural redesign rather than narrative optimism. Until liquidity formation becomes meaningfully distributed, dependence remains embedded in market architecture.

Recognizing this does not imply imminent crisis. Instead, it encourages sober evaluation. Crypto exchange centralization is a structural condition, not a temporary anomaly.

Crypto Exchange Centralization Conclusion

Crypto networks may operate without central control, yet markets remain dependent on centralized infrastructure. This divergence shapes systemic risk more than short-term volatility.

Exchange concentration improves efficiency while amplifying exposure. As markets mature, resilience will depend on whether liquidity and custody become more distributed or remain clustered.

Understanding this structural dynamic allows participants to evaluate risk beyond price charts. Markets do not fail because of volatility alone. They fail when infrastructure concentration meets stress.