Crypto Ownership Responsibilities

Owning crypto is often framed as freedom. Control over assets, independence from intermediaries, and global accessibility are presented as advantages that set digital assets apart from traditional finance. Yet this framing leaves out a crucial dimension: responsibility. When individuals hold crypto directly, they assume roles that were previously handled by institutions, systems, and legal safeguards.

Crypto ownership changes the relationship between users and their assets. There is no automatic protection layer, no default recovery mechanism, and no customer support desk at the protocol level. Decisions that once felt abstract now carry direct consequences. Mistakes are not inconveniences; they are permanent outcomes.

This shift catches many users off guard. The technology works as designed, but expectations are often shaped by experiences with banks, apps, and centralized platforms. Understanding what owning crypto truly implies requires moving beyond interfaces and market narratives toward accountability.

This article examines the less visible side of crypto ownership. It explores the responsibilities that come with holding digital assets and why awareness—not convenience—is the foundation of long-term participation.

Ownership Without Intermediaries

Traditional financial systems rely on intermediaries to absorb responsibility. Banks reverse transactions, custodians safeguard assets, and institutions provide recourse when things go wrong. Crypto removes much of this structure by design.

When individuals hold crypto directly, ownership is absolute. Control rests with whoever holds the private keys, and that control cannot be delegated invisibly. There is no distinction between access and authority. The system does not recognize intent, error, or circumstance—only cryptographic proof.

This form of ownership is powerful, but it is also unforgiving. Losing access means losing assets. Sending funds incorrectly means they are gone. These outcomes are not failures of the system; they are expressions of how it functions.

For many users, this represents a fundamental shift. Owning crypto without intermediaries transfers responsibility from organizations to individuals. Understanding that shift is essential, because it defines every other obligation that follows—from security to record-keeping to legal exposure.

Custody Is a Legal and Practical Obligation

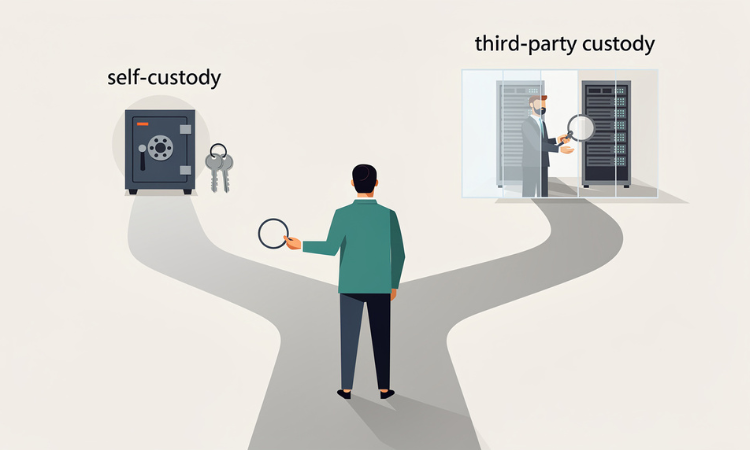

Custody is often discussed as a technical choice, but it is also a legal and practical responsibility. Whether assets are held personally or through a third party determines who bears liability, who controls access, and who answers when something goes wrong.

Self-custody places the burden entirely on the individual. Managing keys, backups, and recovery processes becomes a personal obligation rather than a service provided by an institution. This level of control offers independence, but it also removes safety nets that many users assume still exist.

Third-party custody shifts some operational responsibility back to platforms, but it does not eliminate user accountability. Legal ownership, reporting duties, and compliance obligations often remain with the asset holder, regardless of who controls the interface.

Confusion arises when custody is mistaken for protection. Holding assets through an app does not guarantee recourse, nor does it exempt users from the consequences of misuse or neglect. Understanding custody as an obligation—not a feature—clarifies the role individuals play when they choose to own crypto.

Security Is Not Optional

Security failures in crypto are frequently attributed to hacking, yet many losses result from human error. Weak storage practices, exposed recovery phrases, and poor operational discipline account for a significant share of incidents.

Owning digital assets requires adopting a security mindset. Private keys represent total control, and protecting them is not optional. Unlike passwords, keys cannot be reset. Once compromised, access is permanently transferred.

This reality shifts responsibility away from platforms and toward users. The system does not distinguish between malicious activity and accidental disclosure. Both produce the same result.

Security, therefore, is not an advanced skill reserved for experts. It is a baseline requirement of ownership. Those who underestimate this responsibility often learn its importance through irreversible loss rather than preparation.

Record-Keeping and Traceability

Crypto transactions feel informal, but they leave permanent records. Every transfer, interaction, and balance change is traceable on public ledgers, even when identities are not immediately visible.

For asset holders, this creates an obligation to maintain accurate records. Transaction histories become essential for audits, compliance, and dispute resolution. Relying on platforms to retain this data indefinitely is risky, as access can change or disappear.

Poor record-keeping does not erase activity. It only removes the user’s ability to explain it. Over time, gaps in documentation can lead to confusion, errors, or legal exposure that could have been avoided with consistent tracking.

Traceability is a feature of crypto systems, not a loophole. Recognizing this early helps users align behavior with long-term accountability rather than short-term convenience.

Legal and Tax Exposure

Legal responsibility does not begin when assets are sold or exchanged. In many jurisdictions, simply holding or transferring digital assets creates obligations that users may not anticipate.

Tax treatment, reporting thresholds, and disclosure requirements vary, but ignorance rarely offers protection. The absence of immediate enforcement does not eliminate responsibility; it only delays consequences.

Crypto ownership places individuals within existing legal frameworks, even when the technology itself feels separate. Transactions that appear private or informal can still trigger reporting duties or compliance requirements.

Understanding this exposure is part of responsible participation. Laws may evolve, but the principle remains consistent: ownership carries obligations that extend beyond technical control.

Irreversibility and Finality

One of the most underestimated aspects of crypto ownership is finality. Transactions, once confirmed, cannot be reversed through appeals, support tickets, or institutional intervention. The system does not pause to question intent or verify correctness.

This finality changes how responsibility must be approached. Small mistakes—incorrect addresses, wrong networks, misplaced decimals—carry permanent consequences. What feels like a simple action often has no undo function.

Traditional systems soften these edges through chargebacks and dispute resolution. Crypto removes that layer entirely. While this increases efficiency and reduces reliance on intermediaries, it also demands greater care from users.

Accepting irreversibility is part of adapting to crypto ownership. It requires slowing down decisions, verifying details, and treating each transaction as final by default rather than assuming recoverability.

Responsibility Across Jurisdictions

Crypto operates globally, but responsibility does not. Laws, reporting requirements, and enforcement practices vary by country, and these differences matter even when assets move seamlessly across borders.

Users may hold assets while traveling, relocating, or operating across jurisdictions. Each change introduces new obligations, sometimes without clear notification. Compliance is tied to residency, citizenship, and activity, not merely to technology.

In this context, owning crypto creates layered responsibility. Actions taken in one place can have consequences elsewhere. The decentralized nature of networks does not override legal geography.

Awareness of jurisdictional differences helps prevent unintended exposure. Responsibility does not disappear because rules are inconsistent; it increases as complexity grows.

The Psychological Burden of Control

Control is often portrayed as empowering, but it also carries psychological weight. Managing assets directly requires constant attention, decision-making, and risk assessment.

Responsibility can become a source of stress. Fear of loss, uncertainty about compliance, and anxiety around security decisions affect how users interact with their holdings. These pressures are rarely discussed but widely experienced.

Many users underestimate this burden when first acquiring crypto. Over time, the responsibility of ownership reshapes behavior, sometimes leading individuals to seek simplified solutions or delegated control.

Recognizing this psychological dimension is part of maturity. Responsibility is not only technical or legal; it is cognitive and emotional as well.

Conclusion Crypto Ownership Responsibilities

Owning crypto is not a passive act. It represents a shift in responsibility from institutions to individuals, affecting security, legality, and decision-making in ways that are often overlooked.

The technology enables autonomy, but autonomy comes with obligation. Control over assets also means control over outcomes, including mistakes, losses, and compliance failures.

Understanding these hidden responsibilities allows users to participate with clarity rather than illusion. Awareness does not eliminate risk, but it transforms ownership from speculation into informed engagement.

FAQ Crypto Ownership Responsibilities

Is owning crypto risky?

It involves responsibility rather than guaranteed protection. Risk depends largely on how ownership is managed.

Do I have legal responsibilities if I only hold crypto?

Yes. Holding assets can create obligations related to reporting and compliance, depending on jurisdiction.

What happens if I lose access to my wallet?

There is no recovery mechanism at the protocol level. Loss of access typically means permanent loss of assets.

Can mistakes be reversed?

Most blockchain transactions are irreversible once confirmed.

Should beginners self-custody?

Self-custody requires preparation and discipline. It may not suit everyone immediately.